This is what I thought it would feel like swing trading:

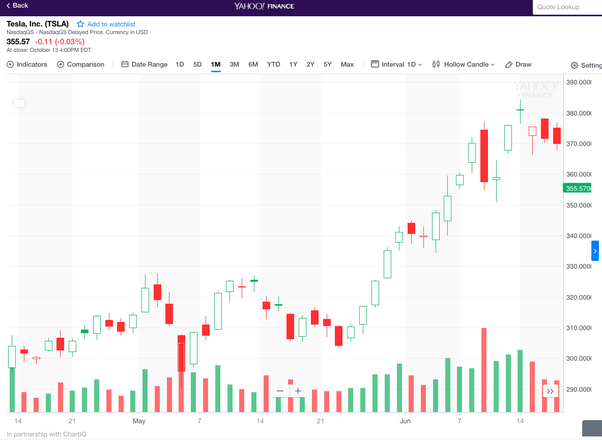

This is what it often really felt like:

[A Quick Note: I am not a licensed broker or investor. This is not advice. Stock investing is a risk: you can lose your money. Please consult a licensed stock advisor before investing.]

Is it possible to make a living swing trading?

Yes, you can. The question to add is What is a good living in your book?

If your answer is $1,500-$6,000 a month part-time, then yes. It’s possible. However, it’s all dependent on a few major requirements:

- You have capital to work with. Ideally, you should open a broker account with at least $50,000 — $150,000 in my opinion [1]. You have to buy a lot of shares to make any real money. Losing some of this initial capital is the price of learning, so keep that in mind!

- You have patience to learn the craft. Learning the technical side of trading can take ten weeks or ten years. It all depends on your aptitude, attitude, and discipline to master the skills.

- You have to be level-headed: that is, you’re not easily swayed by emotion. Technical trading is about spotting patterns and taking action. You can’t be influenced by the news or make emotional buys/sells. And, you must be able to mentally handle inevitable losing streaks and financial losses.

- You have the access to technology. Many stock screeners are free, but some advanced ones you pay for really make a difference. All you need is a computer, software, and the internet to do this work.

There are a few more things you’ll need in your investment quiver, but these are the basics. Below is my experience with trading.

Context

I got into stock trading because I took a year off from teaching college and high school business courses. It was like early retirement for me. I had all the time in the world to do whatever I wanted. I didn’t know if I was ever going back to education. Being frugal, I still wanted to dabble with money-making opportunities at my disposal.

Swing trading was one option, so I tried it.

As a business teacher, I already knew a lot about trading and personal finance. But that didn’t matter much because you could teach a ten-year old how to trade.

It was really the technical aspects that I had to learn. (In trading analysis, there is the fundamental side and the technical side. View this 2m video of you are not familiar with the difference.) I took a short course on charting, read a couple swing trading books, and then I was off to the races.

I predominantly did swing trading, not day trading. I’ve done some day trading (buy and sell in a day). However, my biggest wins have been from swing trading. I’d buy and sell a stock after holding on to it for a few days or weeks.

I got scared a few times and a little fundamentalist theory influenced my buying. In the beginning, part of my criteria was that I’d buy “long swing” (I don’t know if this is a term) stocks that were severely undervalued from a fundamentalist’s point of view. That way if I was wrong about the stock, I could hang on to it for a few months and at least break even.

This was a terrible strategy. Technical traders should never look at the longer term horizon. In fact, the company could go bankrupt in the few months and it wouldn’t matter. As long as you time your entry and exit points correctly, you’ll make money.

This was an aspect I didn’t like about technical analysis, but enjoyed about fundamental analysis. With fundamental companies, I could talk about them to other people and (maybe) predict their future growth. It was exciting to read about these companies in the news and keep up with their innovations.

With technical trading, all the knowledge you learn about a company was meaningless outside of swing trading. Patterns come and go, like companies come and go. I felt like I was filling my head with random data that wouldn’t matter a few days later.

Early Swing Trading Efforts

At first, I did extremely well. It was late 2014 and the market was robust. As mentioned, I traded a lot of obscure stocks. I also traded a few popular stocks and made thousands on them. They include NFLX (Netflix), AMZN (Amazon), ATVI, (Activision Blizzard), and MU (Micron Technology).

I mainly worked with technology and pharmaceutical stocks. Having a narrow industry focus was a crucial lesson I learned early on.

I made a mistake of listening to the Motley Fool guys (I had a one-year subscription to their basic stock advisory service). My mistake: they are not short-hold swing traders. They are interested in growth stocks you hang on to for months or years. They suggested you buy at least 10 stocks, possibly 20.

For any new trader, I wouldn’t buy more than five different stocks at a time. In fact, three is just fine unless you have lots of time and money to work with. The reason is that you’re trying to know these stocks inside and out. It’s hard to process the reams of data on just one company. Now think about doing that with several stocks (long or short-term).

Swing traders are looking for a pattern, but a lot of criteria is put into the mix. We can talk about trade volume, standard patterns (like “cup and handle”), and stock price — but that’s for another time. Basically, you have to decide which of these patterns make the most sense for the company at hand, plus the patterns of your previous wins.

Trading is like playing a game of chess with a giant countdown timer right in front of you the whole time. It can be very stressful as you process data and make your move in real-time.

The goal is to get into a trade at the right time (at the very start of its up-trending) and get out at the right time (at the very start of its down-trending). Your profit is the difference.

So if I came in at $100 and exited at $105, I would net $5. Now multiply that by the amount of shares you bought. Say it was 100 shares — you just walked with $500. (If I exited at $95, I would lose $500!) A kid could do this.

There is a broad continuum of where the trade lands and you get better at timing as you gain experience.

If you “short sell” a company, it’s basically the same strategy in theory. Short selling is like betting against a company: you predict their stock will decline and when they do, you recoup the difference. Short-selling and options were too technical and risky for me, so I usually steered clear of those kinds of trades. As I mentioned, I’m not a pro at trading by any means.

Good Data, Not More Data

What I learned quickly is that it’s not the amount of data you collect on a company or trade. What matters is the quality of data. You can spend days or hours just on one trade, but it makes better sense to act on a solid trading strategy augmented by high-quality data.

I lost a lot of money because I was comparing dozens of patterns for one stock in one time period. It made my head explode. Eventually, I came to my senses and focused on just a few patterns and a few companies. I set up watch lists and alert systems. I even had my trading day all planned out.

In the end, I only traded 2–4 hours a day maximum. I did this just a few days a week. I think I did alright for myself considering I was working on so many other things in my life (micro-businesses, hobbies, travel, writing, etc). In total, I traded about 15 hours a week.

I was thinking about substitute teaching at a local college or high school, but the simple math stopped me. Subs make $155-$180 a day. I was making that and more before 11 am. Ultimately, when I got consistent at this subbing just seemed like a waste of time. Some days I made more in three days than a full-time teacher would make in a whole month!

Bad Trading Moments

I’ll never forget late August 2015. I lost over ten thousand dollars in a single day and it was unnerving. The whole financial world felt the shockwaves of this day as a massive sell-off commenced. But in a few months, things bounced back. I recouped most of the money.

Another time I’ll never forget is when VRX (Valeant Pharmaceuticals) dropped 40% in one day. It’s been puttering along ever since. I was slow to liquidate the stock I bought at $250 and that’s now worth $13 today. I lost thousands and it was painful to see the drama all around this unfold. It was like watching a home burn down. They are going to rebuild it, but it will never be the same or as great as it was. (Note to self: set a Stop Loss trigger price.)

Just recently, I was watching a diabetes medical device. This one was made in my home town and it had lots of promise (DXCM, DexCom). I bought DXCM stock right before it got FDA approval. I felt great about the buy. Then a day later Abbott Laboratories releases a similar glucose-monitoring product and DXCM tanked. And that’s part of swing trading. You can’t know everything and you’re destined to lose trades.

Less Trading

A few years into swing trading, and I can say I learned a lot. I’ve made more than I’ve lost. I’m up about 16% ROI year to date. I’ve had way better years, but that’s decent.

You can look at my 16% ROI and think, wow that’s great. But it’s not that great really. There are dozens of non-swing trade systems that completely blew my results away. Many are incredibly passive (that is, low maintenance).

Also, my ROI percentage for one year doesn’t make as much sense as my average weekly income. It was a goal to average at least $300 a day trading 3 days of the week. If I was on target, that became a decent monthly income you could live on in most places. I look at it more like that.

More importantly, I now have an odd skill set that produces results, most the time. In fact, I recently bought two Apple laptops and paid cash from two short trades I made. I hate debt and credit cards, so it was empowering to do this.

Was It All Luck Or Skill?

Deep down I think that even though I spent hundreds of hours learning to swing trade, my success was partly due to two things beyond me:

- The bull market cycle.

- Beginner’s luck.

I got into trading during an economic cycle that has been one of the longest bull markets in history. (BTW, it’s likely to end soon.) Granted you can make money swing trading in any kind of market, the bull was on my side for sure.

As far as beginner’s luck, I had it. I placed small investments and kept adding to what worked. Some trades would only be $1,000 worth of shares. I was experimenting with scientifically-informed decisions.

Sometimes I got lucky when I double-downed on a stock, and I can’t always say it was because I knew what I was doing. I think a lot of confirmation bias comes with winning trades.

I’ve always been a fundamentalist at heart. I’ve idolized Warren Buffett and Charlie Munger in the past. I see their trading style as 70% Value Investing and 30% Growth Investing (though that ratio is highly debatable). These billionaire investors are in it for the long hall, decades even. There is something to be said about their phenomenal success.

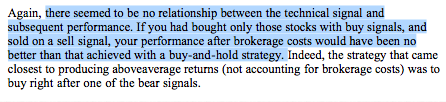

Then there is the analysis from one of the most celebrated investment books of all time: A Random Walk Down Wall Street. In it, the economist Burton Malkiel talks about scientifically testing the efficacy of technical trading:

Put another way, if I never did any swing trading and invested all my money into a handful of diverse Vanguard or Dimensional funds, I would have gotten 8%-14% ROI from sitting on my butt!

No learning, no headaches, no problem.

Plus, you have to factor in all the mental anguish some trades has caused me. I had many sleepless nights. This wasn’t because of the massive eye strain staring at screens did to me (though I did wear special eye glasses for this). Losing trades really took a toll on me. Sometimes I couldn’t be level-headed. I didn’t want to jump off a ledge, but there is a lot of anxiety that comes with swing and day trading. The financial crisis of 2008 caused 5,000 suicides. Many of those people were traders.

These days, I trade less to keep my sanity. Trading doesn’t improve the world much or add value to something great: it only adds to your bottom line.

Life is more than padding your wallet.

If your personal life is starting to look like a crazy candle-stick stock chart that swings from one end to the other, what kind of life have you created? It’s just not worth it in the end.

ABC: Always Be Capitalizing

I believe what Robert Kiyosaki believes. You should always be investing, whether you’re an employee or a business owner. However, you have to invest the way that makes sense to you. It doesn’t have to be the center of your world or cause you massive mood swings.

If you have the capital and you’re interested in picking your own stocks, you could start with only investing 5%–10% of your funds. With the rest, have it professionally managed by people with Ph.D’s in economics and advanced degrees in asset management.

Teams of people who do this for a living with decades of experience are smarter than just you at this game. Let them worry about the details. Have them set up an ideal portfolio for your situation. You’ll sleep fine at night.

So what should you do with your time instead of mastering swing trading?

Find what you really want to do with your life that adds value to the world, and get to work!

[This article was originally featured in The Ascent, a top publication in Medium.]

NOTES

- Investment Ideas — I got some good info and stock ideas from what they were doing at TraderHR.

- Broker Accounts — I recommend MerrillEdge or Schwab’s High-Yield Investor Checking account. BofA’s MerrillEdge will give you lots of free trades (no fees) if you open an account with over $50,000. You can start a Schwab account for as little as $1,000. It conveniently connects a broker account to a checking and savings account. Plus, all ATM banking fees are reimbursed.

- Schwab Advice — The quarterly print magazine Schwab mails to you is worth its weight in gold. I’d seriously pay for it, but it’s free with your account. It has great articles for long-term investors of every stripe. Contact me directly if you want a referral to a great advisor I trust.